HSBC Mortgage Rates 2025: Complete Guide to Current Rates, Types & How to Get the Best Deal

HSBC, one of the world's largest banking and financial services organizations, offers competitive mortgage rates for homebuyers across the UK and internationally. Whether you're a first-time buyer, looking to remortgage, or investing in property, understanding HSBC's current mortgage offerings can help you make informed decisions about your home financing. This comprehensive guide covers everything you need to know about HSBC mortgages.

Overview of HSBC Mortgages

HSBC provides mortgage products in multiple countries including the UK, USA, Canada, Australia, and Hong Kong. As a global bank, HSBC offers unique advantages including products for international buyers and premier banking customers with preferential rates. The bank's mortgage division serves hundreds of thousands of homeowners worldwide.

HSBC's Mortgage Philosophy

HSBC positions itself as a responsible lender with thorough affordability assessments. The bank offers both direct-to-consumer mortgages and broker-distributed products. HSBC Premier and HSBC Advance customers often receive preferential rates and fee waivers as part of their banking relationship benefits.

Types of HSBC Mortgages

Fixed-Rate Mortgages

Fixed-rate mortgages provide payment certainty with locked interest rates for a specified period:

- 2-Year Fixed: Short-term stability, typically lower rates, more flexibility

- 3-Year Fixed: Medium-term option balancing rate and flexibility

- 5-Year Fixed: Longer protection against rate increases, popular choice

- 10-Year Fixed: Maximum stability, premium over shorter terms

Fixed rates are ideal for borrowers who want budget certainty and protection against interest rate increases. The trade-off is potentially higher initial rates compared to trackers and limited flexibility.

Tracker Mortgages

Tracker mortgages follow the Bank of England base rate plus a set percentage:

- How They Work: Rate moves up or down with base rate changes

- Benefits: Potentially lower rates when base rate falls

- Risks: Payments increase when base rate rises

- Best For: Those expecting rates to fall or stay stable

Discounted Variable Rate Mortgages

These offer a discount off HSBC's Standard Variable Rate (SVR) for a set period:

- Initial Period: Typically 2-5 years of discounted rates

- After Discount: Reverts to SVR which may be higher

- Flexibility: Often allows overpayments and has lower ERCs

Interest-Only Mortgages

Interest-only mortgages require only interest payments during the term, with the capital due at the end:

- Requirements: Higher deposit (typically 25%+) and repayment strategy

- Repayment Vehicles: Investments, property sale, pension, savings

- Risk: Must ensure capital can be repaid at term end

- Availability: More restricted than capital repayment mortgages

Buy-to-Let Mortgages

For property investors, HSBC offers specialized buy-to-let products:

- Higher Deposits: Typically 25-40% required

- Rental Coverage: Rent must exceed mortgage payment by specified percentage

- Tax Considerations: Interest relief restrictions affect profitability

- Portfolio Landlords: Special products for those with 4+ properties

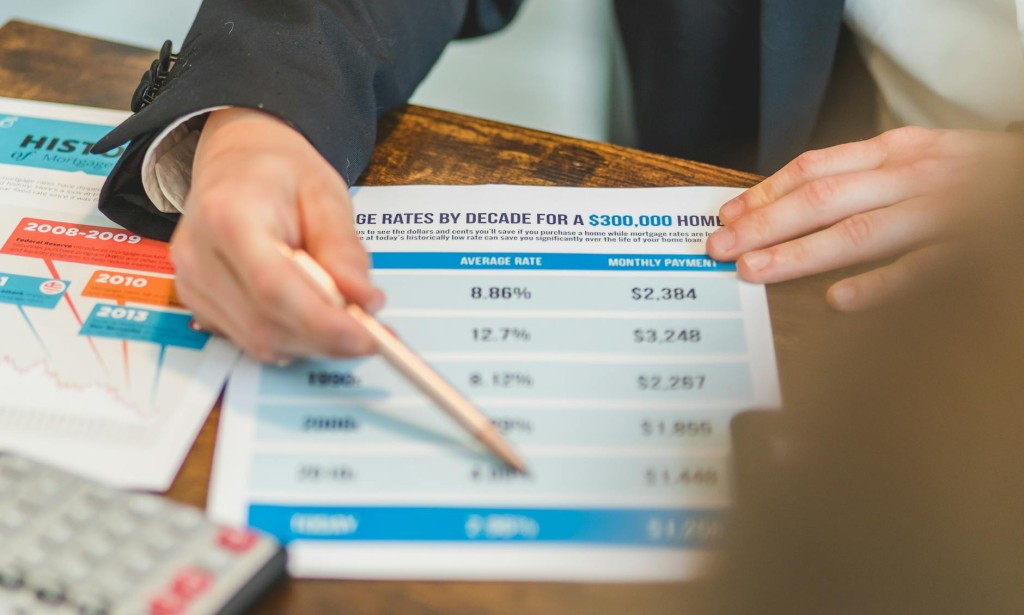

Current HSBC Mortgage Rates

HSBC mortgage rates vary based on loan-to-value ratio, product type, and customer relationship. Here's a general overview of rate structures (rates change frequently - always verify current rates directly):

Rate Factors

| Factor | Impact on Rate |

|---|---|

| Loan-to-Value (LTV) | Lower LTV = Better rates (60% LTV gets best rates) |

| Product Type | Fixed rates typically higher than trackers initially |

| Term Length | Longer fixes have rate premium |

| Customer Status | HSBC Premier customers get preferential rates |

| Property Type | Standard properties get best rates |

LTV Tiers

- Up to 60% LTV: Best rates, lowest risk tier

- Up to 75% LTV: Competitive rates, standard tier

- Up to 85% LTV: Higher rates, increased risk premium

- Up to 90% LTV: Premium rates, stricter criteria

- 95% LTV: Limited availability, highest rates

HSBC Mortgage Features and Benefits

Overpayment Options

Most HSBC mortgages allow overpayments up to 10% of the outstanding balance per year without penalties. This enables borrowers to:

- Reduce overall interest paid

- Shorten mortgage term

- Build equity faster

- Improve position for remortgaging

Payment Holidays

HSBC may offer payment holidays under certain circumstances after a minimum payment history. This provides temporary relief during financial difficulties though interest continues to accrue.

Porting

HSBC mortgages are typically portable, meaning you can transfer your existing mortgage rate to a new property when moving. This saves early repayment charges and preserves favorable rates.

Cashback Offers

Some HSBC mortgage products include cashback at completion, helping offset legal fees, moving costs, or home improvements. Cashback amounts vary by product and may affect the overall rate.

HSBC Premier and Advance Benefits

HSBC offers tiered banking relationships with mortgage benefits:

HSBC Premier

- Eligibility: Income requirements or savings/investment thresholds

- Rate Discounts: Exclusive rates not available to standard customers

- Fee Waivers: Potential arrangement fee reductions

- Dedicated Support: Relationship manager assistance

- International: Benefits if relocating abroad

HSBC Advance

- Eligibility: Lower thresholds than Premier

- Benefits: Some preferential rates and fee reductions

- Travel Insurance: Included benefits package

- Pathway to Premier: Building relationship for future benefits

How to Apply for an HSBC Mortgage

Eligibility Requirements

HSBC assesses mortgage applications based on:

- Income: Verified employment or self-employment income

- Credit History: Credit score and payment history

- Deposit: Minimum typically 5-10% for residential

- Affordability: Ability to pay at higher stress-tested rates

- Property: Acceptable property type and condition

Documentation Required

Prepare these documents for your HSBC mortgage application:

- Identity: Passport, driving license

- Address: Utility bills, bank statements

- Income: Payslips (3 months), P60, SA302 for self-employed

- Bank Statements: 3 months showing income and outgoings

- Deposit: Evidence of deposit source

Application Process

- Decision in Principle: Online or in-branch initial assessment

- Full Application: Submit complete documentation

- Valuation: HSBC arranges property valuation

- Underwriting: Final assessment and approval

- Offer: Formal mortgage offer issued

- Completion: Legal work and funds transfer

HSBC vs Other Lenders

How HSBC compares to other major UK mortgage lenders:

Strengths

- Competitive rates especially for Premier customers

- International capabilities for expats and relocators

- Strong digital tools and online account management

- Established global bank with stability

- Good overpayment flexibility

Considerations

- Strict affordability assessments

- May not have lowest rates for standard customers

- Limited availability through brokers for some products

- Branch network smaller than some UK-focused banks

Tips for Getting the Best HSBC Mortgage Rate

Maximize your chances of securing favorable terms:

Before Applying

- Improve Credit Score: Pay bills on time, reduce credit utilization

- Save Larger Deposit: Better LTV means better rates

- Consider HSBC Banking: Premier status unlocks best rates

- Reduce Debts: Lower debt-to-income improves affordability

- Stabilize Employment: Permanent roles preferred over contract

During Application

- Compare Products: Assess total cost including fees

- Use Broker: May access exclusive rates

- Negotiate: Ask about rate matching or fee waivers

- Time It Right: Rate changes happen; lock when favorable

HSBC Mortgage Fees and Costs

Understanding all costs associated with HSBC mortgages:

Common Fees

| Fee Type | Typical Amount | Notes |

|---|---|---|

| Arrangement Fee | £0 - £999+ | Can often add to loan |

| Valuation Fee | £0 - £500+ | Often free on certain products |

| Legal Fees | £500 - £1,500+ | Free conveyancing on some remortgages |

| Early Repayment Charge | 1-5% of balance | Applies during fixed/discount period |

True Cost Calculation

When comparing mortgages, calculate the total cost over the initial rate period including all fees. A slightly higher rate with no fees may be cheaper than a lower rate with high arrangement fees.

Remortgaging with HSBC

HSBC offers remortgage products for existing homeowners:

Reasons to Remortgage

- Current deal ending and moving to SVR

- Better rates available in the market

- Releasing equity for home improvements

- Consolidating debts (though this extends debt term)

- Changing to different product type

HSBC Remortgage Process

- Existing HSBC Customers: Product transfer may be simpler

- New to HSBC: Full application and valuation required

- Incentives: Free legal work and valuations often available

- Timing: Start process 3-6 months before current deal ends

First-Time Buyer Guide

HSBC supports first-time buyers with specific products and guidance:

First-Time Buyer Products

- 95% LTV Mortgages: Only 5% deposit required

- Help to Buy: HSBC participates in government schemes

- Shared Ownership: Products for part-buy-part-rent

- Family Support: Products using family savings as security

Tips for First-Time Buyers

- Use a Lifetime ISA for bonus on deposit

- Check all government schemes you qualify for

- Factor in stamp duty (relief for first-time buyers)

- Budget for all buying costs beyond deposit

- Consider new-build incentives

Understanding Mortgage Affordability

HSBC uses strict affordability calculations to ensure borrowers can manage payments both now and in the future. Understanding these calculations helps you prepare for application success.

Income Multiples

Traditionally lenders offered mortgages at 4-4.5x income. HSBC may lend up to 5.5x for high earners with strong finances. However, affordability assessments now focus more on actual income versus expenditure analysis.

Stress Testing

HSBC tests affordability at rates higher than the actual mortgage rate to ensure borrowers can cope with potential rate rises. This stress test rate is typically 3% above the actual rate or the lender's SVR, whichever is higher.

Expenditure Assessment

Your monthly outgoings are scrutinized including:

- Existing debt repayments (loans, credit cards, car finance)

- Childcare costs

- Regular commitments (subscriptions, maintenance payments)

- Lifestyle costs (estimated from spending patterns)

- Council tax and utilities estimates for new property

Property Types and HSBC Criteria

Not all properties qualify for HSBC mortgages. Understanding acceptable property types prevents wasted applications.

Standard Properties (Best Rates)

- Houses (detached, semi-detached, terraced)

- Purpose-built flats with traditional construction

- New build properties from approved developers

- Bungalows

Properties Requiring Assessment

- High-rise flats (floor and construction dependent)

- Ex-local authority properties

- Non-standard construction

- Properties with annexes

- Agricultural ties or restrictions

Properties Often Declined

- Properties above commercial premises (some cases)

- Freehold flats without share of freehold

- Properties with very short leases

- Steel-framed construction

- Properties requiring significant repairs

Understanding Early Repayment Charges

ERCs are penalties for paying off your mortgage early during the initial deal period. HSBC's ERC structure varies by product:

Typical ERC Structure

| Year of Fixed Period | Typical ERC |

|---|---|

| Year 1 | 3-5% |

| Year 2 | 2-4% |

| Year 3 | 1-3% |

| Year 4 | 1-2% |

| Year 5 | 1% |

When ERCs Apply

- Paying off mortgage entirely during deal period

- Overpaying beyond allowed percentage

- Remortgaging to another lender during deal period

- Selling property (unless porting)

HSBC Digital Tools and Services

HSBC provides comprehensive digital mortgage management:

Online Application

- Decision in Principle available 24/7

- Document upload functionality

- Application tracking

- Secure messaging with mortgage team

Account Management

- View mortgage balance and statements

- Make overpayments online

- Request payment holidays

- Access annual statements and tax documents

Mobile App Features

- Payment notifications

- Balance updates

- Direct secure messaging

- Integration with HSBC current account

International and Expat Mortgages

HSBC's global presence makes it particularly suited for international buyers:

UK Properties for Overseas Buyers

- Available to residents of certain countries

- Higher deposit requirements (typically 25%+)

- Income verification from overseas sources

- Currency considerations

Expat Products

- For UK citizens working abroad

- Must typically have UK ties (property, family)

- Income in foreign currency assessed

- May require larger deposit

Returning to UK

- Products for expats returning home

- May accept job offer as proof of income

- HSBC global relationship benefits transfer

Market Outlook and Rate Considerations

Understanding market conditions helps with mortgage timing decisions:

Factors Affecting Rates

- Bank of England Base Rate: Primary driver of mortgage rates

- SWAP Rates: Determine fixed rate pricing

- Competition: Lender competition can lower rates

- Economic Outlook: Inflation and growth expectations

- Regulatory Changes: Capital requirements affect pricing

When to Lock In

Consider fixing if:

- Rates are expected to rise

- You need payment certainty for budgeting

- You're risk-averse about payment changes

- Your income is fixed and can't absorb increases

Common Mistakes to Avoid

Avoid these errors when applying for an HSBC mortgage:

Before Application

- Opening new credit before applying

- Large unexplained deposits

- Changing jobs during application

- Missed payments on any credit

- Not checking credit report for errors

During Application

- Incomplete documentation submission

- Inconsistent information between documents

- Not disclosing all debts and commitments

- Making changes to deposit source

- Applying for other credit during process

Getting Professional Help

Consider whether professional assistance would benefit your situation:

Mortgage Brokers

- Access to whole-of-market comparison

- May access exclusive HSBC rates

- Handle application paperwork

- Provide ongoing advice

- Fee-free options available (paid by lender)

When to Use a Broker

- Complex circumstances (self-employed, adverse credit)

- First-time buyer needing guidance

- Limited time to research market yourself

- Need help with paperwork and process

Going Direct to HSBC

- Simple application with good credit

- Already HSBC Premier customer

- Want to maintain single banking relationship

- Confident in comparing products yourself

Protecting Your Mortgage and Home

Beyond securing the mortgage itself, consider protection options:

Life Insurance

Decreasing term life insurance matches your mortgage balance, ensuring the mortgage is paid off if you die during the term. This protects your family from losing their home. Many lenders and advisers recommend coverage equal to your mortgage amount.

Income Protection

Income protection insurance pays a percentage of your salary if you cannot work due to illness or injury. This helps maintain mortgage payments during difficult times when your regular income is interrupted.

Critical Illness Cover

Critical illness insurance pays a lump sum on diagnosis of specified conditions like cancer, stroke, or heart attack. This can be used to pay off or reduce your mortgage, relieving financial pressure during recovery.

Buildings Insurance

Required by all mortgage lenders, buildings insurance covers the cost of rebuilding your property. HSBC will require proof of adequate coverage before completion. Your policy must name HSBC as interested party.

Contents Insurance

While not required by lenders, contents insurance protects your belongings. Combined buildings and contents policies often offer better value than separate policies from different providers.

Frequently Asked Questions

What credit score do I need for an HSBC mortgage?

HSBC doesn't publish minimum credit score requirements. They assess overall creditworthiness including credit history, current debts, and payment behavior. Generally, a score above 700 (Experian) improves chances. Applicants with CCJs, bankruptcies, or recent defaults may struggle to qualify.

Can I get an HSBC mortgage as a self-employed person?

Yes, HSBC offers mortgages to self-employed borrowers. You'll typically need 2-3 years of accounts or tax returns (SA302s). Income is usually calculated as an average of recent years. Accountant-prepared accounts strengthen applications.

How long does HSBC mortgage approval take?

HSBC's Decision in Principle takes minutes online. Full application approval typically takes 2-4 weeks depending on complexity, valuation timing, and documentation completeness. Complex applications (self-employed, unusual properties) may take longer.

Can I port my HSBC mortgage to a new property?

Most HSBC mortgages are portable, subject to the new property meeting their criteria and your circumstances still meeting affordability requirements. Contact HSBC early in your moving process to understand options.

What happens at the end of my HSBC fixed rate?

When your fixed rate ends, you'll move to HSBC's Standard Variable Rate (SVR) unless you arrange a new deal. The SVR is typically higher than fixed rates. Start looking at remortgage options 3-6 months before your fixed rate ends.

Does HSBC offer mortgages for older borrowers?

HSBC considers applications from older borrowers though terms may need to be shorter. The maximum mortgage age limit varies by product. Proving income in retirement (pension, investments) is key for older applicants.

HSBC Customer Support

HSBC provides multiple support channels for mortgage customers including phone helplines, secure online messaging, in-branch appointments, and mobile app support. Premier customers receive dedicated relationship manager access for priority assistance with mortgage queries and product changes. Response times vary by channel and query complexity.

Conclusion

HSBC mortgages offer comprehensive and competitive options for various borrower needs, from first-time buyers to property investors. The bank's Premier program provides significant rate benefits for qualifying customers. When choosing an HSBC mortgage, compare total costs including fees, consider your future plans, and ensure payments fit comfortably within your budget. Start the application process early, gather documentation thoroughly, and consider speaking with a mortgage adviser to ensure you're getting the best possible deal for your specific circumstances and financial goals.

You must be logged in to post a comment.